All insights

3 min watch

How top private asset managers continuously outperform

Top private managers continue to be top performers - making it important to back the right managers.

5 min watch

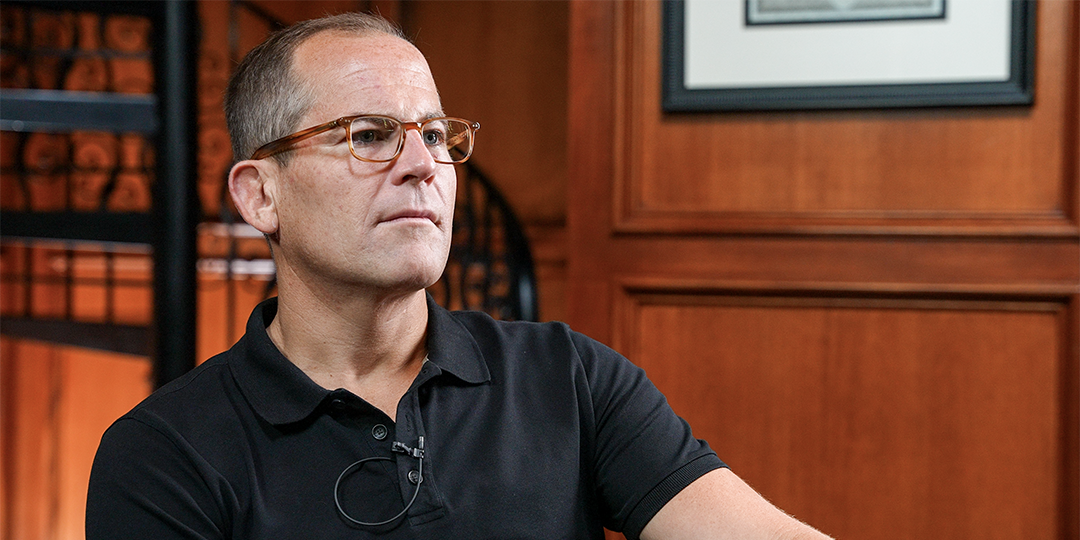

Hellman & Friedman's private equity strategy

Erik Ragatz discusses the firm's focused approach to PE investment and selecting companies

5 min watch

What is private credit and what role can it play in portfolios?

Keri Findley gives an overview of what private credit is and how it can fit in your portfolio.

2 min watch

What are the pros and cons of fund-of-funds structures?

Understand why and when investors may consider fund-of-funds structures to access private assets

5 min watch

Logistics overhaul: Investing in the backbone of America

What is logistics? What are the industry problems and what opportunities do they create for innovation?

3 min watch

UTIMCO's Britt Harris on transitioning to alts

What do investors need to know before adding alternatives to their portfolios?

%20(1).png?width=600&height=338&name=menu_thumbnail%20(4)%20(1).png)