Key takeaways

- In an uncertain macroeconomic environment with upside risks to inflation, advisors might consider seeking out income sources that are typically uncorrelated or weakly correlated to major economic drivers.

- We see particularly interesting opportunities in: Litigation Finance, Media and Intellectual Property, Asset-Based Lending, and Private Capital in Sports.

- Diversifying into these niche asset classes, perhaps through a custom fund, could potentially reduce risk in a portfolio via exposure to different return drivers.

In the short term, it is unclear how long interest rates will remain elevated, though there are signs that the battle to tame inflation may take longer than hoped. Even if inflation moderates later this year, there are longer-term inflationary trends that may require that interest rates remain higher than we have become accustomed to for most of the past two decades, including:

-

The reversal of globalization trends, particularly in the labor market

-

Potential elevated costs as the clean energy transition picks up momentum

-

Tighter labor markets as major Western and Asian societies age

-

The end of more than a decade of cautious consumer borrowing globally following the Global Financial Crisis1

In the short term, higher interest rates have made public bond yields more attractive (and perhaps reduced the attractiveness of certain less-risky private income strategies, such as core commercial real estate, and senior private credit). But the lack of certainty around rates and inflation makes planning for the income portion of a client portfolio more complicated.

In such an uncertain macroeconomic environment with upside risks to inflation, advisors might consider adopting a slightly more creative approach to income generation. We would particularly recommend seeking out asset classes with income and return streams that are commonly uncorrelated or weakly correlated to major economic drivers and the broader markets.

This could include integrating a few emerging, less-well-known private strategies into the income portion of a portfolio, potentially via a dedicated custom fund. Some of the most interesting are:

-

Litigation Finance

-

Media and Intellectual Property

-

Asset-Based Lending

-

Private Capital in Sports

Litigation Finance

What is it?

Put simply, litigation finance strategies include either or both of:

-

Providing funding for lawsuits in exchange for a share of any profit that might result. This, in effect, treats a good legal claim as an asset with a potential revenue stream. The investment risk is tied to the outcome of the individual case, but should be priced into the financing deal. Cases invested in are varied and range from mass torts and class actions to personal injury, antitrust, appellate financing, and intellectual property. Or…

-

Investing directly in law firms where the collateral is the firm’s docket of cases and guarantees from partners

Why is it uncorrelated to the market?

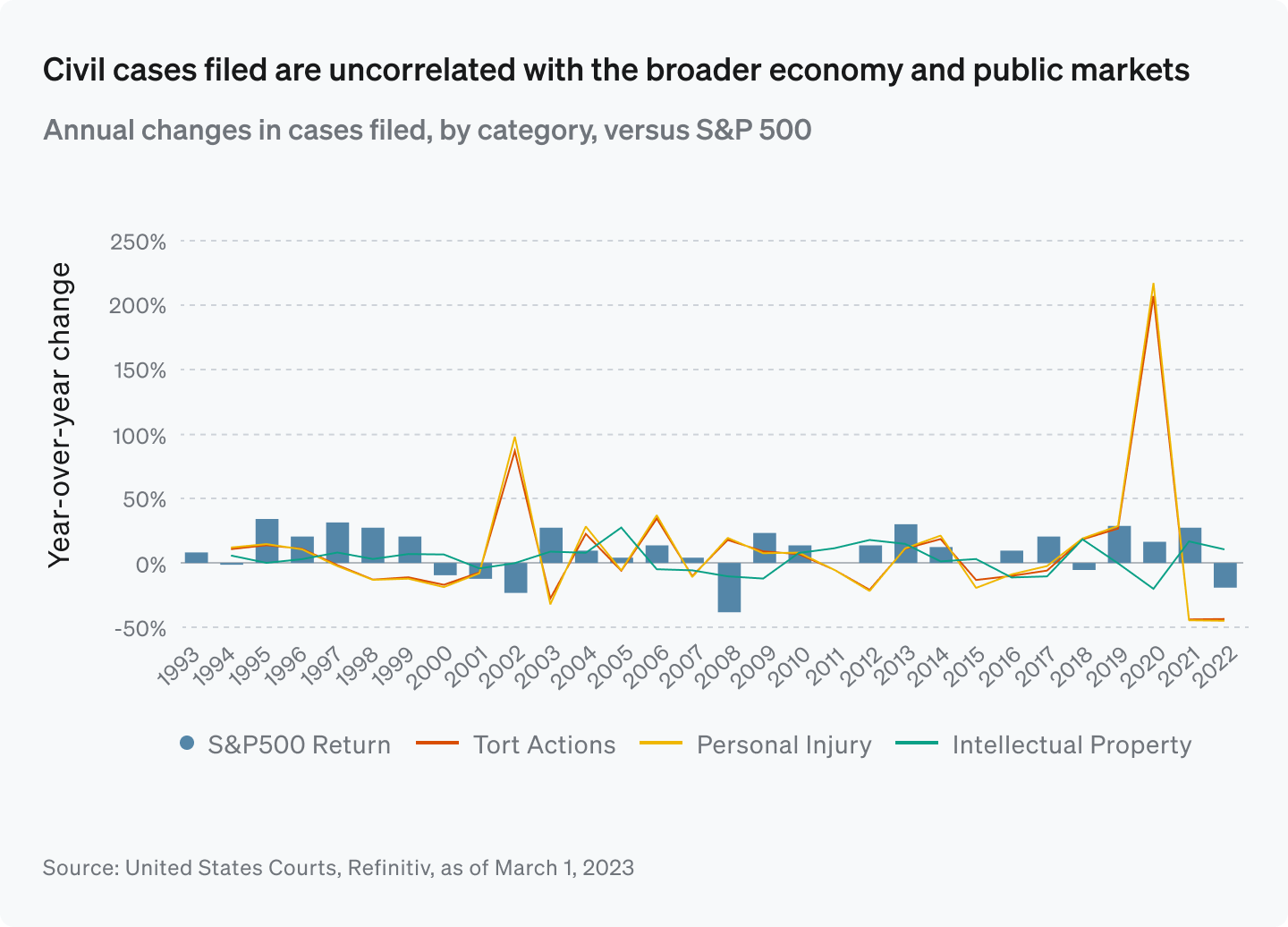

Investment returns from litigation finance are driven by case outcomes, which are uncorrelated with macro factors (see chart below). Legal processes continue no matter the economic environment, and in total have remained above 250,000 a year in the US since 1996.2

What is driving this opportunity?

Despite growth, there remains a mismatch between the institutional capital raised for litigation finance and the annual legal fees accrued from litigation. Traditional banks have not evolved to support greater underwriting of legal cases. Additionally, many plaintiff law firms lack credit options in specific case types like mass torts. Large litigation lenders do not generally focus on mass torts, law firms lack expertise in optimizing their capital structures, and few participants or lenders understand the asset base and the business model.

Media and Intellectual Property

What is it?

Media and Intellectual Property (IP) as an asset class involves buying the rights to revenue streams from sectors such as music, film, and pharmaceuticals, among others.

Why is it uncorrelated to the market?

The cash flows from these investments are typically consistent, including appealing cash yields, and have recession-resistant characteristics. Returns are usually uncorrelated to broader markets: Taking music as an example, with the rise of streaming, consumption is no longer as closely linked to shifts in the economy or wealth as it once was.

What is driving this opportunity?

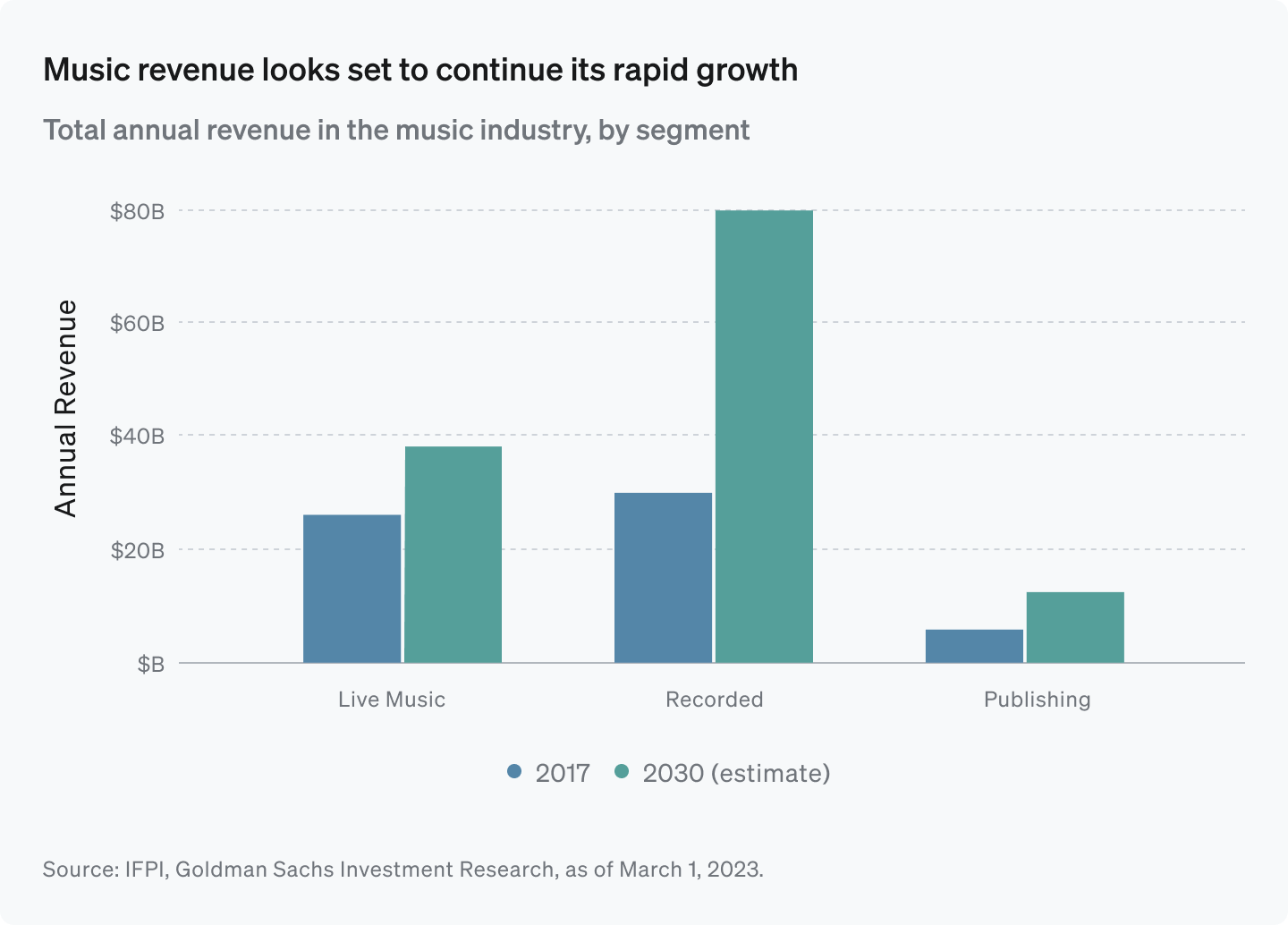

Solid industry fundamentals, as highlighted by recent sales of back catalogs in the entertainment sector by artists such as Justin Bieber, Dr. Dre, and Keith Urban. PwC expects digital music streaming to continue growing, with global revenues projected to grow from $24.5B in 2021 to $36.8B in 2026.3

The growth of tech-enabled consumption, including the global spread of 5G and smartphones, and the digitization of content are opening up new growth niches, notably for live streaming. These processes are underpinning overall industry expansion (see chart below), leading to compelling investment opportunities, and creating new areas of growth, such as licensing to social media platforms and e-fitness companies.

Asset-Based Lending

What is it?

Asset-based lending (ABL) is, as the name suggests, focused on extending loans to companies with specific assets serving as collateral rather than financial collateral from the company’s capital stack. This can include assets ranging from brand names and intellectual property to accounts receivable and real estate. In ABL, the lender typically agrees to lend up to a certain percentage of the value of specified assets, called a borrowing base.

Why is it uncorrelated to the market?

The correlation of ABL returns to the broader market may be weaker than in other lending strategies because they are often independent of borrower performance - being tied to specific assets rather than cash flows - and may stem from multiple different drivers. In a market downturn, ABL usually has several paths to full loan recovery, which can help to reduce risk (though, of course, the risk of investment loss remains), such as:

-

Incorporating “bankruptcy remote” features, with the assets held by a separate entity

-

Negotiated preferential treatment in the event of liquidation

-

Strong asset coverage ratios

What is driving this opportunity?

Increased market volatility has created an opportunity for ABL as certain borrowers have reduced access to traditional credit sources, increasing demand for alternative sources of financing. ABL can supply this at attractive rates while maintaining a relatively senior position in the event of financial distress - similar to “senior secured” private credit lending. There is also ample opportunity to isolate and lend against quality assets. Less stringent credit standards during the recent sustained period of low or zero interest rates offer greater freedom now to carve out assets to use as collateral, particularly as credit conditions have now tightened.

Private Capital in Sports

What is it?

Fairly simply, private capital in sports investment involves investing directly into a sports franchise or league.

Why is it uncorrelated to the market?

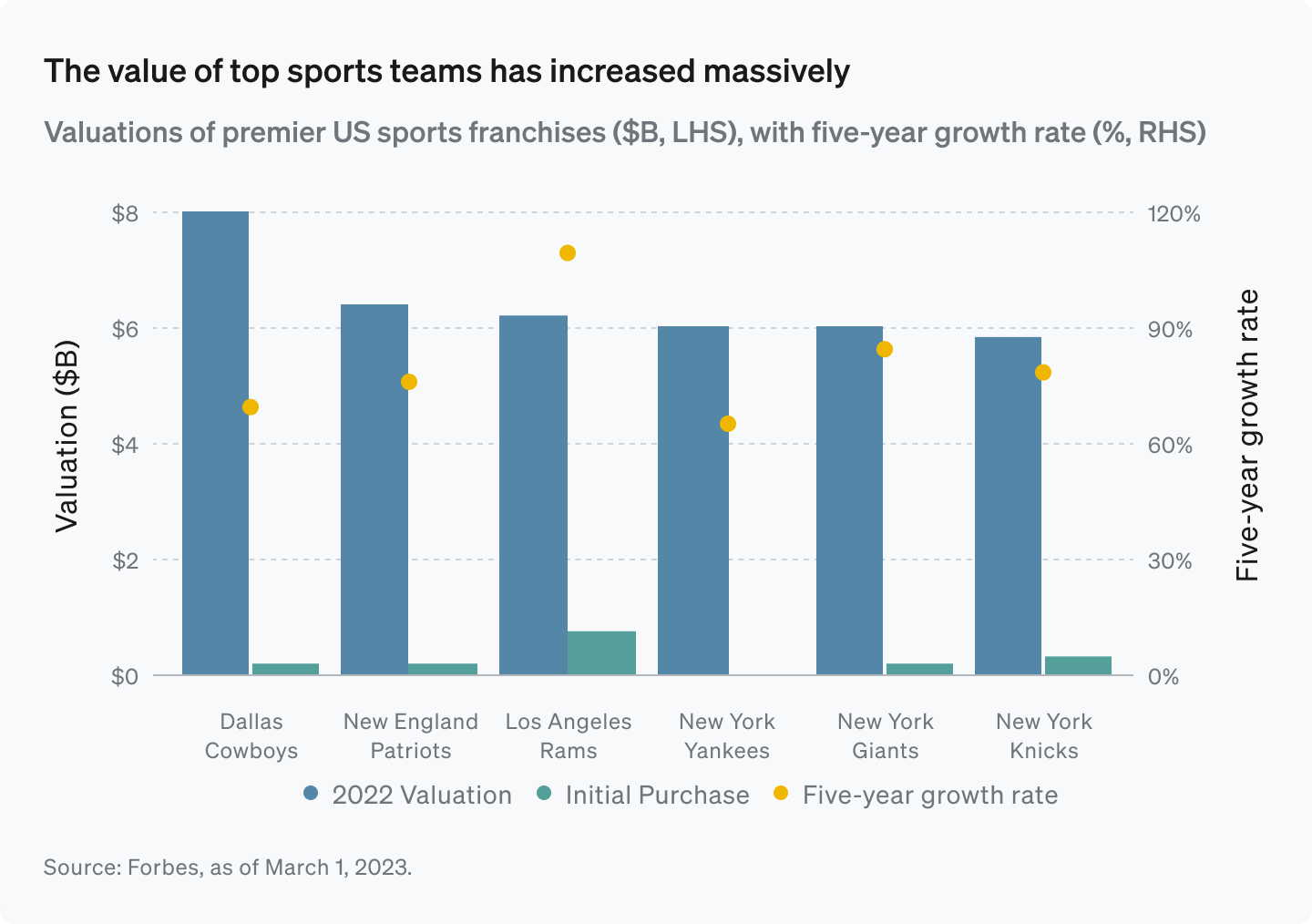

Sports franchises have remained resilient, grown consistently - and at times sharply (see chart below) - and have limited correlation to the broader market due to the inelastic nature of sports demand. Return streams are typically contractual (a significant share of sports revenue comes from media deals and sponsorships), which means reliable income streams. The asset class also offers multiple drivers of returns beyond the most obvious sources - ticketing and merchandising - including tax credits, content generation, and real estate income premiums around stadiums.

What is driving this opportunity?

Sports as an asset class is slowly opening up to outside capital and continued growth in media opportunities like streaming, as well as international expansion, provide further upside to returns generated by improved team performance and franchise value. A constrained supply of sports teams and consistent demand underpin prospects for a successful exit. Historically, the supply of capital has been driven by banks and wealthy individuals, but the market is now opening up to institutions and consortiums4, which provides an opportunity for retail investors to gain exposure.

Portfolio considerations

As the private markets continue to expand, new niches have emerged - and will continue to emerge as fund managers innovate. These examples of growing income-focused strategies are some of the more interesting ones we see, but there are many others.

While ever the trajectory of interest rates remains so uncertain, so will the performance of public fixed-income markets. The range of potential macro outcomes over the coming quarters is wider than we have seen for a while. There is a chance that we do achieve a soft landing, with minimal impacts outside of asset markets, but the probability that we swing into a disinflationary recession or find ourselves in a sustained inflationary environment is uncomfortably high.

In such an environment, advisors may need to consider a little prudent diversification of their clients’ income allocation into more idiosyncratic strategies that are less correlated with markets.

To discuss how Opto may be able to help you construct a fully customized income-focused fund for your practice and/or clients, please get in touch via advisory-services@optoinvest.com.

Endnotes

- Source: McKinsey Global Institute, “A Decade After The Global Financial Crisis: What Has (And Hasn’t) Changed?” as of September 2018.

- Source: United States Courts (uscourts.gov), as of March 1, 2023.

- Source: PricewaterhouseCoopers, “Perspectives from the Global Entertainment & Media Outlook 2022–2026.”

- Source: Buyouts Insider, “How private equity is moving into the big leagues,” as of October 3, 2022.

Important disclosures

Opto Investment Management, LLC (the “Firm”) is a wholly-owned subsidiary of Opto Investments, Inc. and is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. SEC registration does not mean the SEC has approved of the services of the investment adviser. This website is operated and maintained by Opto Investments, Inc. Certain products described herein and institutional relationships may involve investment advisory services provided by the Firm. This website is presented for financial institutions and investment professionals only and is not intended for individual consumers or retail investors, unless specifically noted. Unless otherwise indicated, commentary on this site reflects the personal opinions, viewpoints and analyses of the author and should not be regarded as a description of services provided by the Firm or its affiliates. The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual on any security or advisory service. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice. While all information presented, including from external, linked or independent sources, is believed to be reliable, we make no representation or warranty as to accuracy or completeness. We reserve the right to change any part of these materials without notice and assume no obligation to provide updates. Nothing on this site constitutes investment advice, performance data or a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. We disclaim any responsibility for information, services or products found on linked websites. Images and photographs are included for the sole purpose of visually enhancing the website. None of them show current or former clients and should not be construed as an endorsement or testimonial. All investing is subject to risk, including loss of principal. Historical performance is not a guarantee of future performance and clients may experience different results. This information contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of the depicted investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting operations that could cause actual results to differ materially from projected results. See related disclosures at https://www.optoinvest.com/disclaimers.

%20(1).png?width=600&height=338&name=menu_thumbnail%20(4)%20(1).png)