Key takeaways

- As tighter financial conditions favor suppliers of capital over the coming months, private equity funds that are actively investing capital should benefit from rising pricing power. This could improve returns for fund managers investing in 2023.

- There has been an increase in deals by private equity funds to take public companies private - taking advantage of falling public valuations. This likely foreshadows a rebound in private market deal activity as valuations finally fall on the private side.

- As rising debt costs increase their need for capital, companies that are dependent on external capital should eventually need to accept lower valuations to meet their needs, which we expect to revive slowing deal activity.

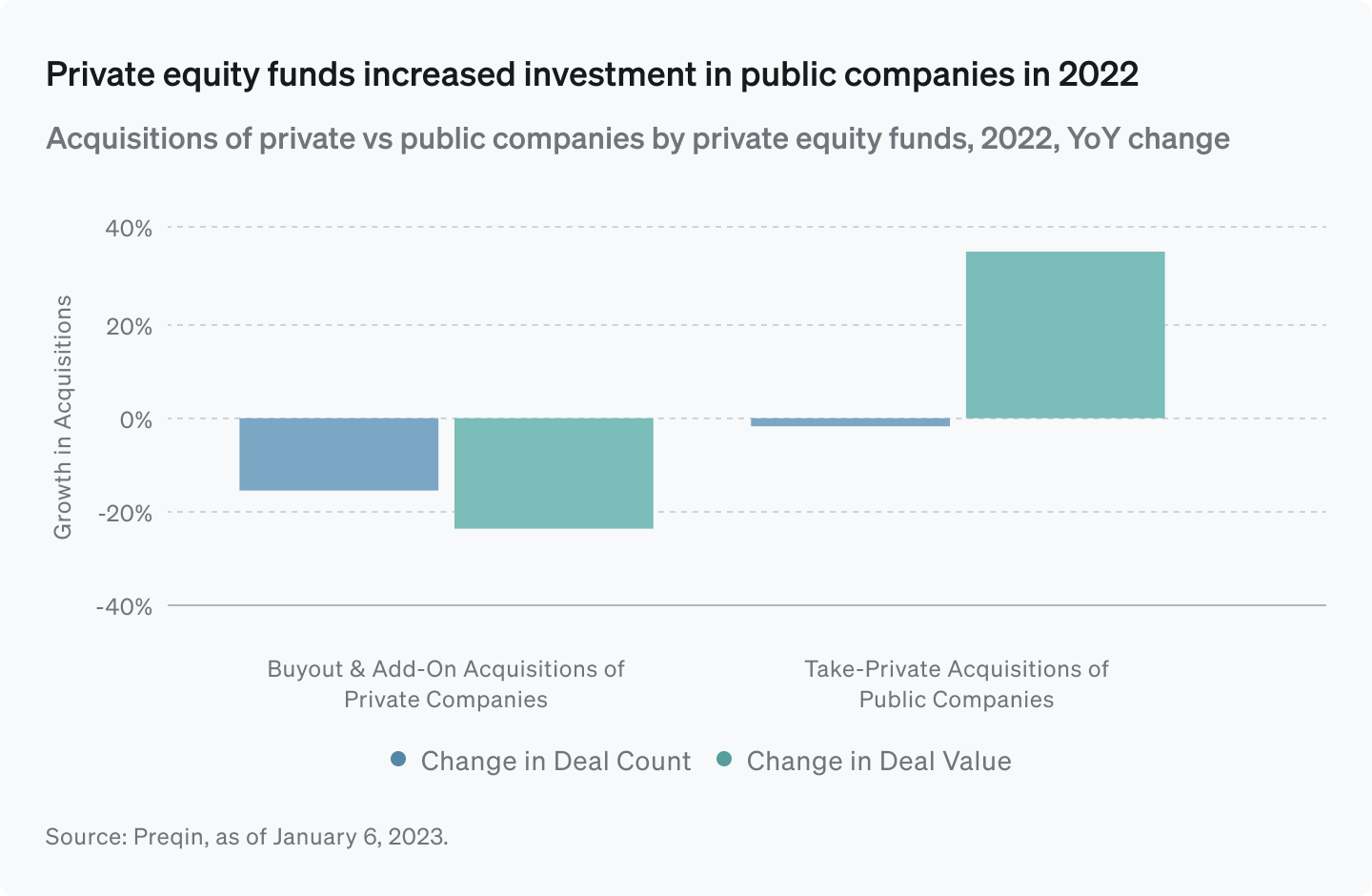

Monitoring private equity (PE) deal activity provides a window into how market dynamics and price pressures are unfolding. In 2022, PE buyout activity for publicly and privately owned companies diverged (see chart below). This was driven by dislocations between: 1) public and private market valuations, and 2) private company buyers and sellers.

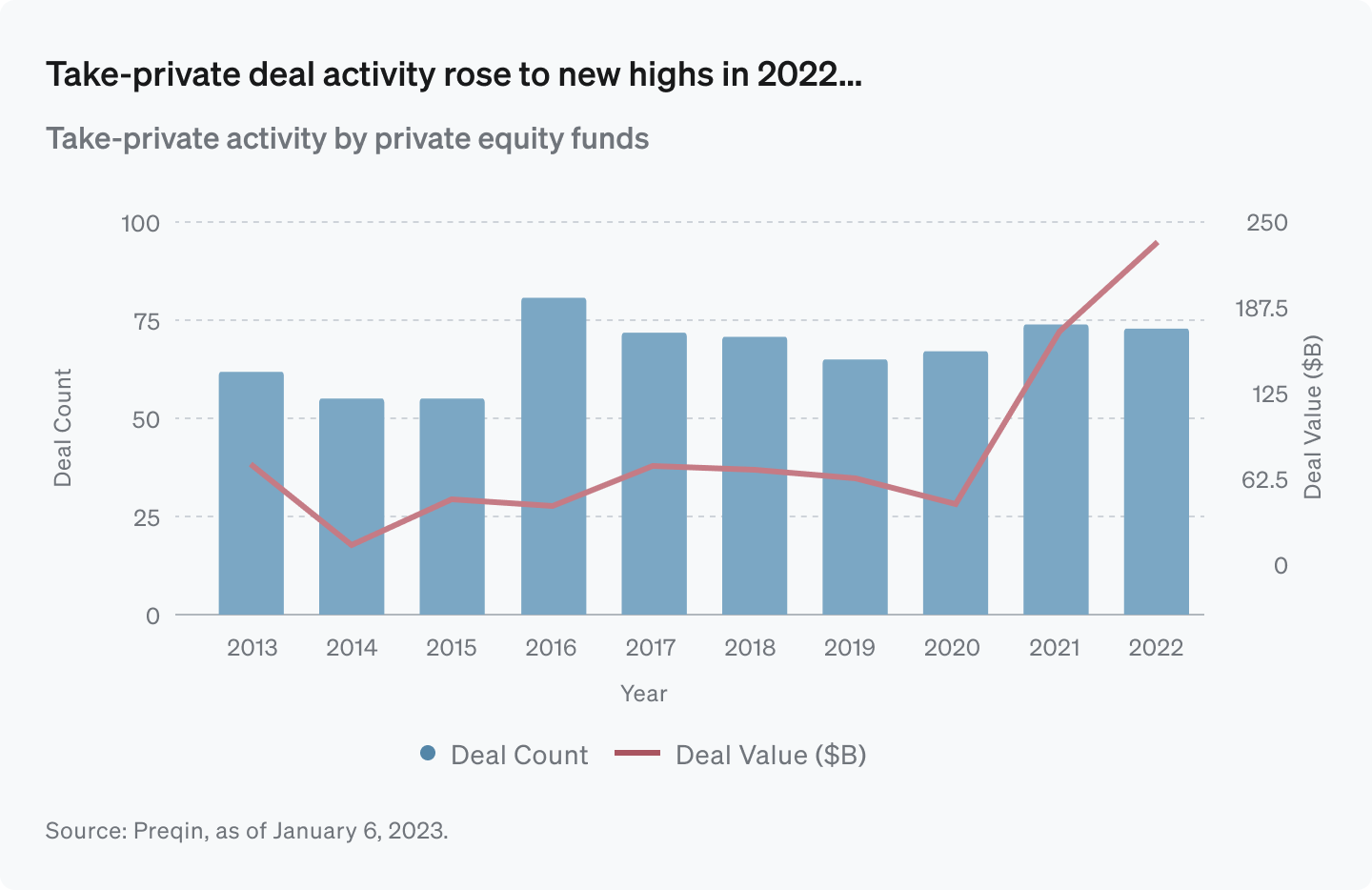

PE managers capitalized on the public equity correction through take-private deals (where they buy a listed company, typically to take advantage of a perceived discount, and take them private). The total deal value for take-privates rose 33% year-over-year in 2022 to a historical high (see chart below).

Take-private activity rose particularly sharply in the tech sector, reflecting public tech stock valuation declines, with deal count up 35% and deal value up 76% year-over-year. (Source: Preqin, as of January 6, 2023.)

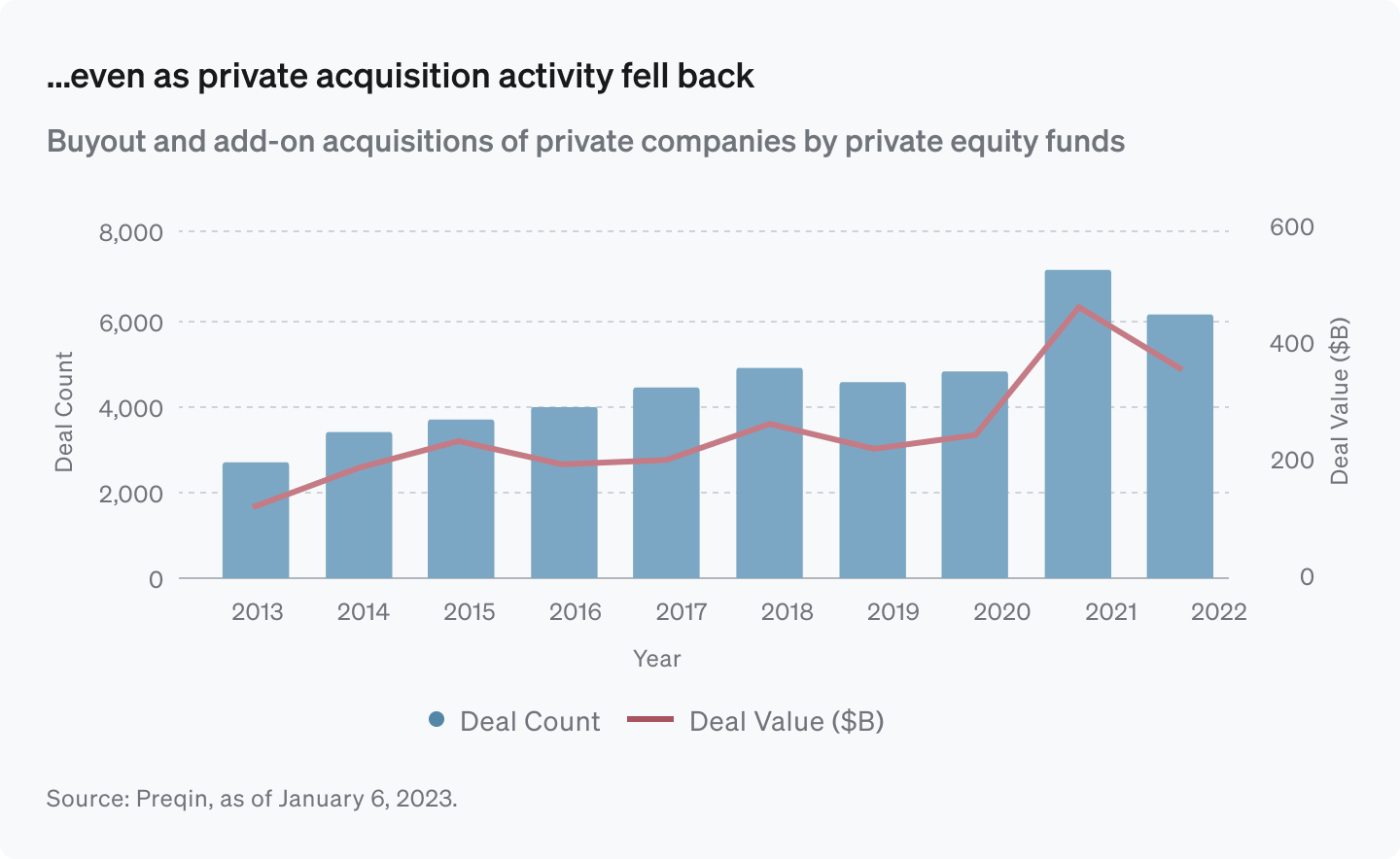

In contrast, private buyouts and add-on acquisitions have slowed in both deal count and deal value terms (see chart below).

Private sellers have been reluctant to accept lower valuations, but this is likely to change in 2023. The slowdown in activity is creating pent-up capital demand from these companies at a time when their needs are growing, given higher debt servicing costs.

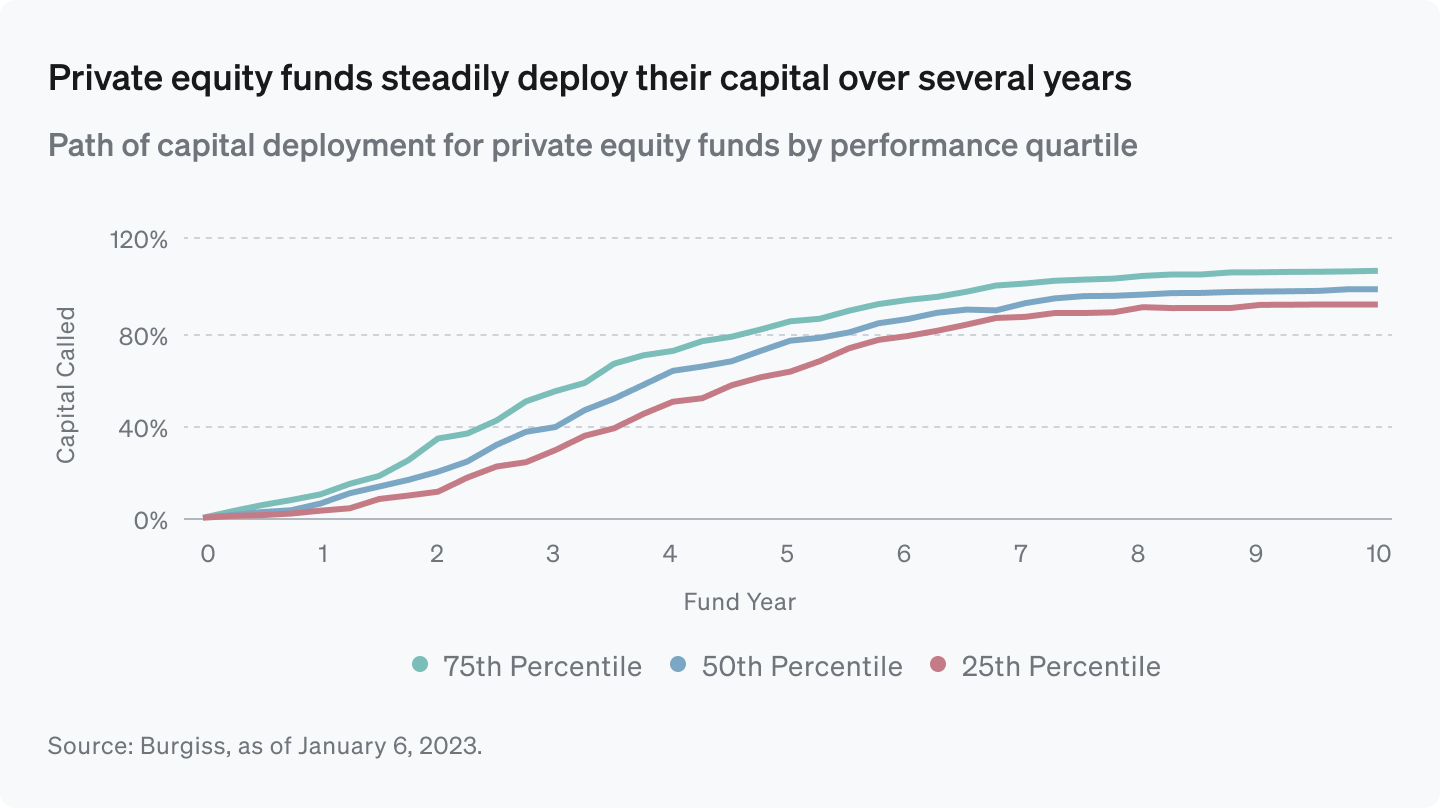

Private fund managers usually invest the bulk of capital committed to their funds gradually over several years (see chart below). Managers deploying capital over the coming quarters are therefore likely to benefit from favorable lending conditions because of the tightening liquidity backdrop, which ultimately may improve returns when they eventually exit these investments.

To explore how Opto can partner with you to help you take advantage of these market dynamics, please get in touch with us at advisory-services@optoinvest.com.

Important disclosures

Opto Investment Management, LLC (the “Firm”) is a wholly-owned subsidiary of Opto Investments, Inc. and is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. SEC registration does not mean the SEC has approved of the services of the investment adviser. This website is operated and maintained by Opto Investments, Inc. Certain products described herein and institutional relationships may involve investment advisory services provided by the Firm. This website is presented for financial institutions and investment professionals only and is not intended for individual consumers or retail investors, unless specifically noted. Unless otherwise indicated, commentary on this site reflects the personal opinions, viewpoints and analyses of the author and should not be regarded as a description of services provided by the Firm or its affiliates. The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual on any security or advisory service. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice. While all information presented, including from external, linked or independent sources, is believed to be reliable, we make no representation or warranty as to accuracy or completeness. We reserve the right to change any part of these materials without notice and assume no obligation to provide updates. Nothing on this site constitutes investment advice, performance data or a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. We disclaim any responsibility for information, services or products found on linked websites. Images and photographs are included for the sole purpose of visually enhancing the website. None of them show current or former clients and should not be construed as an endorsement or testimonial. All investing is subject to risk, including loss of principal. Historical performance is not a guarantee of future performance and clients may experience different results. This information contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of the depicted investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting operations that could cause actual results to differ materially from projected results. See related disclosures at https://www.optoinvest.com/disclaimers.

%20(1).png?width=600&height=338&name=menu_thumbnail%20(4)%20(1).png)