With fees on fund management and performance, do private market fund investments actually make sense?

Key Takeaways

- For many new to the private markets space, fees often cause some pause. Fund fees are structured differently than in private markets, with a 1-2% management fee and a performance/incentive fee (in the neighborhood of 20%) above a target return.

- While these fees may sound high, net of fees private funds (particularly top quartile ones) still outperform public markets - which is why almost all institutional investors hold positions in them.

- Incentive fees can be beneficial in that they incentivize managers to actually make your money work - they're rewarded alongside you.

- Often, fees are also not charged until hurdles are met - which for many asset classes don't kick in until above expected returns for public asset classes.

Transcript

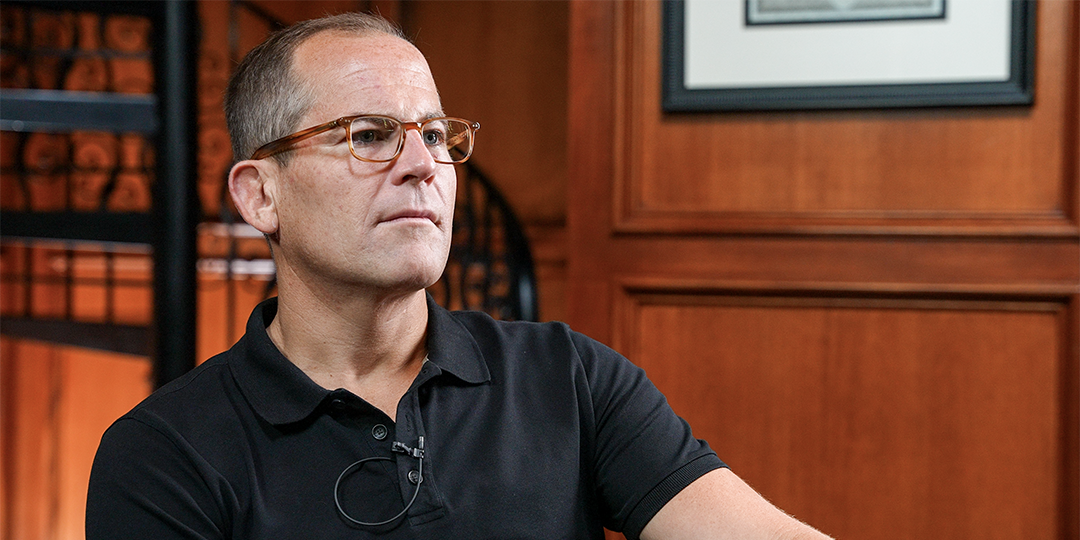

I'm Mark Machin. I was formerly the president and CEO of the Canada Pension Plan Investment Board, or CPP Investments.

I think the biggest misconception or misunderstanding about private markets is fees. The headline fees look certainly look high relative to where a really low-cost public market investing has gone. Now, we're paying management fees, and you're paying carry. It can be quite tough, you know, particularly if you're running a pension fund or an endowment when the public looks at how many millions, hundreds of millions dollars, in my case, billions of dollars, we're spending in fees and carry for the very large private equity and private asset investing portfolio that we had. If you are in those top funds, in the top quartile funds, net of all those fees and expenses, you are going to significantly outperform what we could possibly have achieved in public markets and certainly in passive investing in public markets.

Carry is probably the biggest component of fees or expenses on a lot of these funds. But if you think about carry, number one, you only pay carry if the returns are of a certain hurdle, in most cases, the hurdle on the fund, you're only paying to carry over that. And secondly, it's really a share in success. So you're only paying it if the fund's been successful. Sure. Your carry might be very high if the fund's done incredibly well, but you're paying a share of success. When we looked at the amount of carry that we paid, we were happy with it because the returns had been, you know, above what we had required from a hurdle rate. Hurdle rates of six to 8% would be, you know, typical hurdle rates in private equity. And so you were only paying carry only kicks in above that type of return. Fund managers have to sweat a lot to get to the carry that you're then paying when you look at forward expected returns in public markets today; you would have to be very lucky in public markets to beat those returns.

Important disclosures

Opto Investment Management, LLC (the “Firm”) is a wholly-owned subsidiary of Opto Investments, Inc. and is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. SEC registration does not mean the SEC has approved of the services of the investment adviser. This website is operated and maintained by Opto Investments, Inc. Certain products described herein and institutional relationships may involve investment advisory services provided by the Firm. This website is presented for financial institutions and investment professionals only and is not intended for individual consumers or retail investors, unless specifically noted. Unless otherwise indicated, commentary on this site reflects the personal opinions, viewpoints and analyses of the author and should not be regarded as a description of services provided by the Firm or its affiliates. The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual on any security or advisory service. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice. While all information presented, including from external, linked or independent sources, is believed to be reliable, we make no representation or warranty as to accuracy or completeness. We reserve the right to change any part of these materials without notice and assume no obligation to provide updates. Nothing on this site constitutes investment advice, performance data or a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. We disclaim any responsibility for information, services or products found on linked websites. Images and photographs are included for the sole purpose of visually enhancing the website. None of them show current or former clients and should not be construed as an endorsement or testimonial. All investing is subject to risk, including loss of principal. Historical performance is not a guarantee of future performance and clients may experience different results. This information contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of the depicted investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting operations that could cause actual results to differ materially from projected results. See related disclosures at https://www.optoinvest.com/disclaimers.

%20(1).png?width=600&height=338&name=menu_thumbnail%20(4)%20(1).png)