Funds exit their investments in several ways to return capital to investors at the end of a fund's life

Key Takeaways

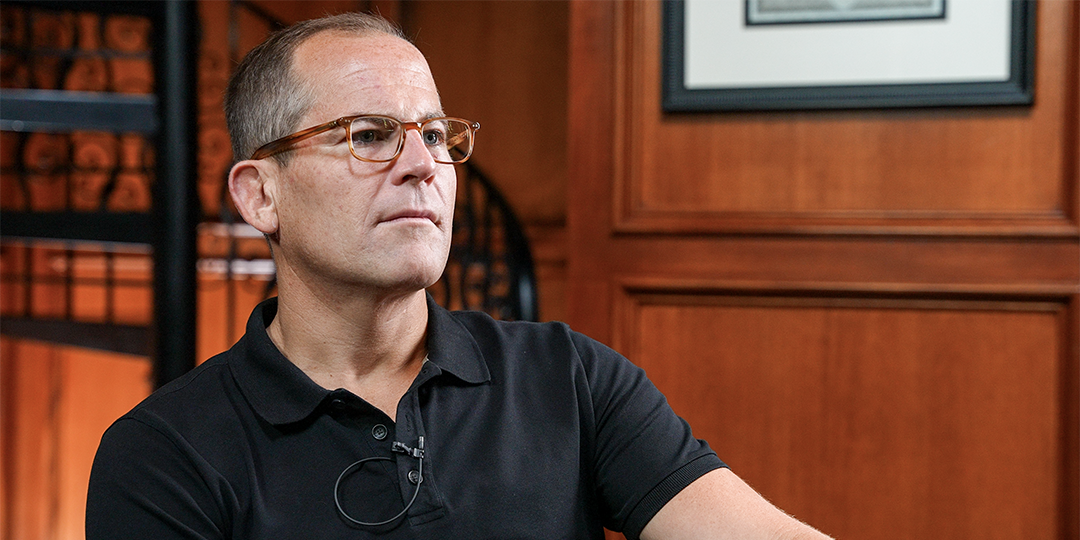

- Ben Blumenrose, managing partner at Designer Fund, an early-stage venture capital firm, explains what happens at the end of a fund's term length.

- Private funds have term lengths that investors agree to - after that they are required to return the money/wind down investments.

- Managers can exit a fund's investments by either leading a portfolio company to IPO or secondary markets sales (if a private equity or venture capital firm) or acquisition/sale of the underlying assets.

- For private equity and venture capital firms, selling their shares of companies on secondaries markets (private exchanges or to funds) can be a great option for liquidity, and doesn't necessarily mean accepting a discount to fair value.

What Happens at the End of a Fund's Term Length?

Hi, I'm Ben Blumenrose, managing partner of Designer Fund. Designer Fund is an investment firm that focuses on investing and founders that value design. We focus on preseed and seed-stage companies and investing in those founders and helping them succeed by building great products, in spaces that lack design innovation - healthcare, financial services, blockchain, AI, and climate tech.

As you come to the tail end of your fund, there are a number of ways for investors [fund managers] to start exiting out of their positions. One is hopefully, most of your later-stage companies are going towards IPO. So that's one way, and you can return the shares to your LPs. Two is acquisitions, so if a company gets to a place where it becomes a meaningful acquisition target is helping your founders find a good landing spot for those companies. But the third that a lot of people don't talk about is there actually are ways for investors and GPs to basically sell part of their stake or even all their stake on secondary markets to get liquidity for their LP. So we have heard about some GPs in the year 11 or 12; they basically sell the entire holdings of their fund to another holder who's more willing to hold it for another two or three, four years and get liquidity for the LP. So that is also an option for GPs to get liquidity and to get returns for their investors.

It's not necessarily that you're selling at a discount; it depends on the company. So if you want to sell some of the shares in a company that you're an investor in before IPO, or before they get bought in the secondary market, some companies you might have to sell a discount, but some companies that are perceived to be doing really well, you can actually sell at a premium to their last round. We have a number of companies that are doing that and are in that tier.

Important disclosures

Opto Investment Management, LLC (the “Firm”) is a wholly-owned subsidiary of Opto Investments, Inc. and is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. SEC registration does not mean the SEC has approved of the services of the investment adviser. This website is operated and maintained by Opto Investments, Inc. Certain products described herein and institutional relationships may involve investment advisory services provided by the Firm. This website is presented for financial institutions and investment professionals only and is not intended for individual consumers or retail investors, unless specifically noted. Unless otherwise indicated, commentary on this site reflects the personal opinions, viewpoints and analyses of the author and should not be regarded as a description of services provided by the Firm or its affiliates. The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual on any security or advisory service. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice. While all information presented, including from external, linked or independent sources, is believed to be reliable, we make no representation or warranty as to accuracy or completeness. We reserve the right to change any part of these materials without notice and assume no obligation to provide updates. Nothing on this site constitutes investment advice, performance data or a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. We disclaim any responsibility for information, services or products found on linked websites. Images and photographs are included for the sole purpose of visually enhancing the website. None of them show current or former clients and should not be construed as an endorsement or testimonial. All investing is subject to risk, including loss of principal. Historical performance is not a guarantee of future performance and clients may experience different results. This information contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of the depicted investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting operations that could cause actual results to differ materially from projected results. See related disclosures at https://www.optoinvest.com/disclaimers.

%20(1).png?width=600&height=338&name=menu_thumbnail%20(4)%20(1).png)